The Ultimate Investment Experience

Quick Setup

Hassle-free registration with Aadhaar/PAN for instant access.

Smart Portfolio

Monitor and optimize your stock and mutual fund investments.

Advanced Trading

Buy/sell stocks, ETFs with real-time data and alerts.

Tax Reports

Seamless tracking of capital gains and tax reports.

SIP Investment

Invest smartly with SIPs, goal-based tools, and fund comparison.

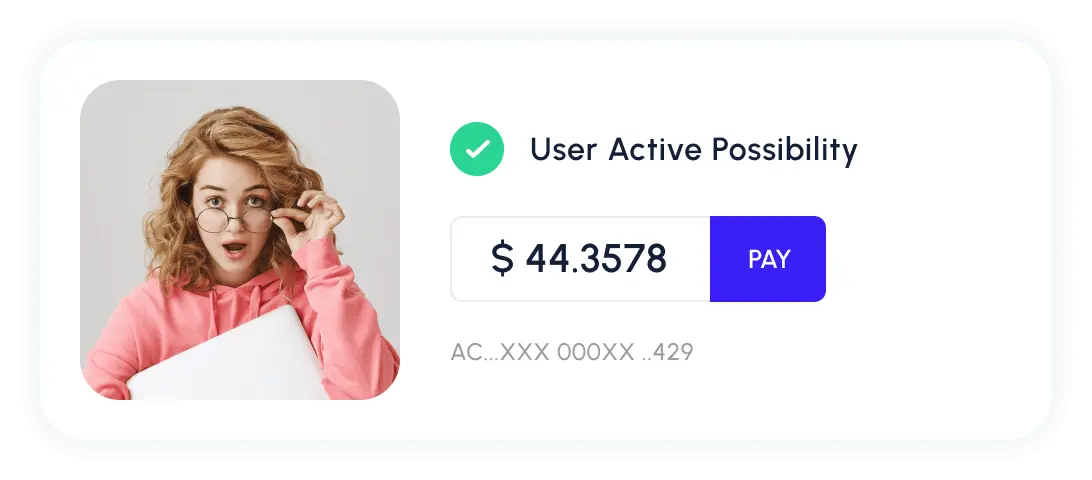

Secure Transactions

Multiple secure payment options with 2FA for your peace of mind.

Invest smarter, track effortlessly, and grow your wealth securely with FinWin.

All-In-One Trading Solution

FinWin Features at a Glance

Mutual Funds

Access a wide range of funds, choose between direct and regular plans, and start SIPs effortlessly.

Education Hub

Learn through blogs, tutorials, and webinars to sharpen your investment knowledge.

Stock Trading

Buy, sell, and monitor stocks with advanced charting and analysis.

Tax & Gains

Get capital gains tracking, tax reports, and easy redemption options.

Getting Started with FinWin

Sign Up

Create your account quickly using Aadhaar or PAN, and verify your identity in seconds.

Choose Your Investments

Select from a wide variety of mutual funds, stocks, and ETFs that match your goals.

Track & Grow

Monitor your investments, receive real-time updates, and make informed decisions to grow your wealth.

FinWin by the Numbers

Join the thousands of satisfied investors who trust FinWin every day.

What Our Investor Says

Bangalore

"As a beginner, I was confused about where to start. FinWin’s education resources helped me learn everything I needed to know."

Mumbai

"I love the real-time alerts. I never miss a trading opportunity anymore."

Delhi

"FinWin makes investing so much easier. From SIPs to tracking my stocks, everything is just a tap away!"

Frequently Asked Questions?

We’ve compiled answers to some of the most common queries about using FinWin. If you have any further questions, feel free to reach out!

You can sign up by downloading the FinWin app and completing the registration process using your Aadhaar or PAN. After that, you’ll go through a quick KYC (Know Your Customer) verification.

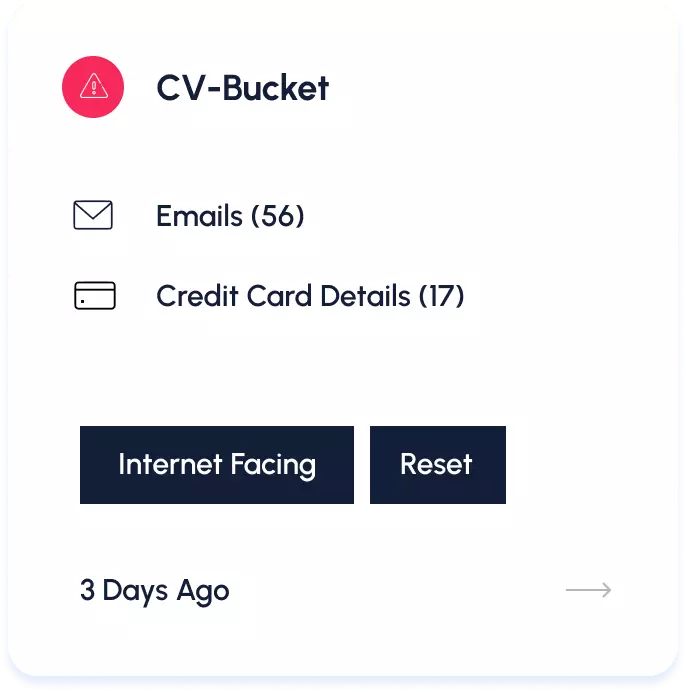

Yes, your transactions are secure. We use two-factor authentication (2FA) and encryption to protect all your personal and financial data.

Absolutely! You can choose from a wide range of mutual funds, set up SIPs (Systematic Investment Plans), and track your investments directly through the app.

Simply fund your account, select your preferred stocks or ETFs, and start trading. We offer real-time market data and tools to help you make informed decisions.

You can track stocks, mutual funds, SIPs, ETFs, and your overall portfolio, all in one place. Get real-time insights and updates on your investments.

FinWin generates automated capital gains and tax reports, helping you easily track your tax obligations for the financial year, so you can stay compliant.

Yes, your account can be accessed across all devices, including smartphones and tablets, allowing you to monitor and manage your investments wherever you are.

The minimum amount to start an SIP (Systematic Investment Plan) is usually as low as ₹500, allowing you to invest gradually over time.

You can redeem your mutual funds or withdraw funds directly through the app by following a simple process. The amount will be credited to your linked bank account within a few working days.

Yes, FinWin provides personalized recommendations based on your financial goals and risk profile. Our algorithm suggests tailored investments that align with your needs.